Sinking fund method of depreciation calculator

Re 01846 at 4 will produce Re 1 in 5 years Solution. An alternative sinking fund formula simply subtracts the.

How Balance Sheet Structure Content Reveal Financial Position Balance Sheet Financial Position Balance

Initial cost of transformer X Rs.

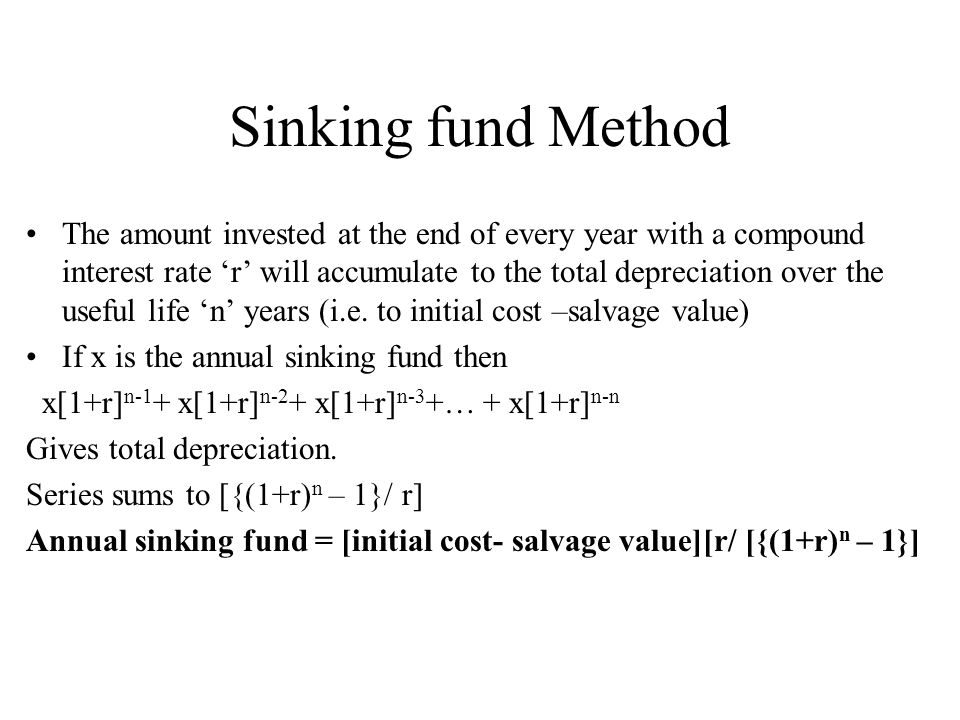

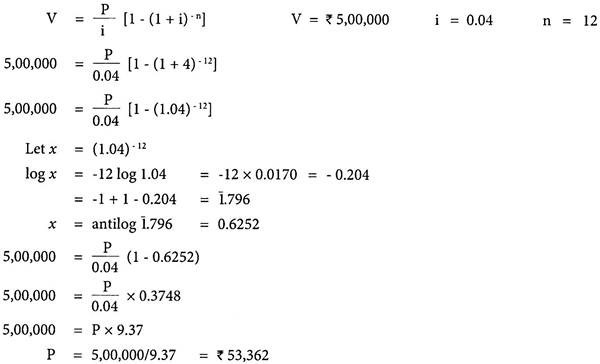

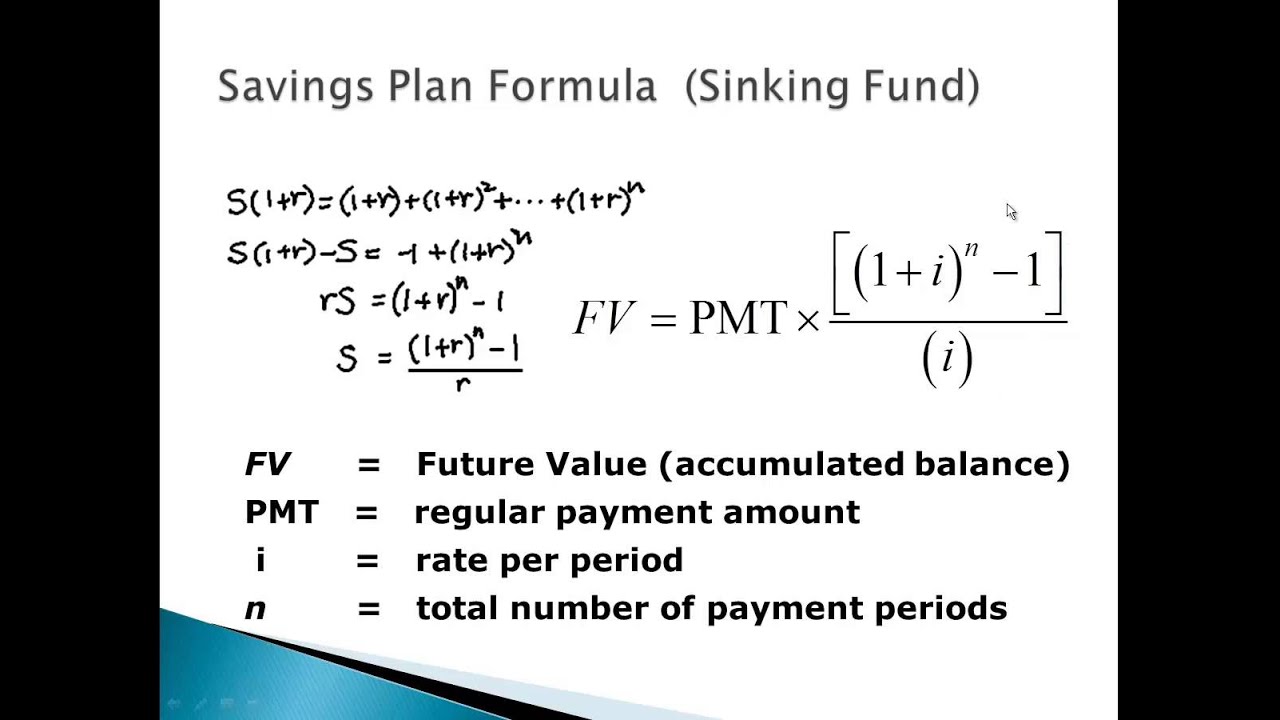

. The sinking fund method is a depreciation technique used to finance the replacement of an asset at the end of its useful life. The formula for sinking fund is as follows. How do you calculate sinking fund factor.

Therefore the calculation of the amount of the sinking fund is as follows Sinking Fund 1612 5-12 1 612 1500 Sinking Fund will be Sinking Fund 10465505. Under straight-line depreciation this would work out to a depreciation expense of 151631 a year for five years. Sinking Fund Table shows that it is necessary to invest 0317208 each year to achieve 1 at the end of 3 years the rate of interest being 5.

150000 Scrap value of transformer S Rs. The sinking fund investments will realize 5. 10000 Useful life of transformer n 25 years Annual rate of interest r 7 Then the annual.

Therefore for 20000 an annual investment of. Show the necessary ledger account. Sinking Fund Depreciation Calculator.

Amount to be Deposited in Sinking Fund Amount of Debt Time Amount to be Deposited 50000 10 Amount to be Deposited 5000 So by establishing a sinking fund company A. Show the necessary accounts in the books of the company for 5 years. As depreciation is incurred a matching.

The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset. The total cost of an asset X value of rupee after four years 5 we got this value from sinking fund table 1000000 X. Enter all entries leave blank what you want to solve for Depreciation Asset Value Salvage Value-- Asset Value-- Salvage Value-- N Total.

Calculate the amount of Depreciation or Investment. To get 1 at the end of 4 years at 4 percent an annual investment of 235490 is necessary. Where A Money Accumulated P Periodic Contribution to the sinking fund r Rate of Interest n number of years m number.

Therefore five annual payments of 17390 earning 7 interest. Solves for various items using the sinking fund depreciation method including depreciation book value Asset Value Salvage Valuehttpswwwmathcelebrity. Enter value and click on calculate.

Sinking Fund Depreciation Method Calculator. For example for i 7 and N 5 years the sinking fund factor is equal to 01739. Enter your search terms Submit search form.

To write off Re 1 at 4 interest annual depreciation will be. The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset. Result will be displayed.

This particular video aims to explain the basic fundamental prin. The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset reaches the. This math video tutorial is a part of a series of videos in the Subject Engineering Economy.

Sinking Fund Depreciation Method Calculator

1

How To Calculate Cost Of Travel Economics Lessons Fuel Cost Travel

Sinking Fund Method Of Depreciation Example Tutor S Tips

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Solution Calculate The Annual Depreciation Cost By Sinking Fund Method At 4 Interest

Sinking Fund Youtube

Amortization Formula

Sinking Fund Method Of Depreciation Accounting Lecture Sabaq Pk Youtube

1

Deprecition Ppt Video Online Download

1

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Introduction To Sinking Funds Youtube

Depreciation Formula Examples With Excel Template

Sinking Fund Method Economics Of Power Generation Power Plant Engineering Youtube

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting